The demonetization move brought down cash withdrawal limit via ATM from INR 20,000 to INR 2,000 per day. Following the deadline of the exchange of old notes, the deciding authorities increased the daily limit of withdrawal from ATMs with effect from January 01, 2017, from INR 2500 to INR 4500 per day per card.

And now, here’s good news, on a review of limits placed on withdrawals from ATMs and current accounts, it has been decided to enhance the same, with immediate effect.

In a released statement the RBI notified that the limit on withdrawals from ATMs has been enhanced from the current limit of INR 4,500 to INR 10,000 per day per card (It will be operative within the existing overall weekly limit). Also, the limit on withdrawal from current accounts has been enhanced from the current limit of INR 50,000 per week to INR 1,00,000 per week and it extends to overdraft and cash credit accounts also.

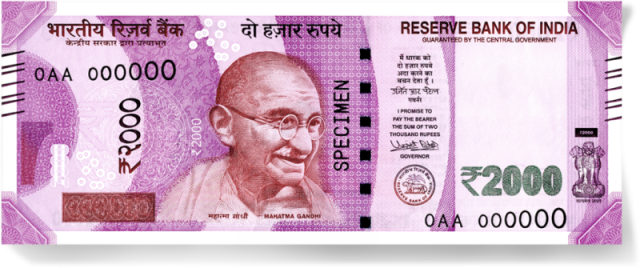

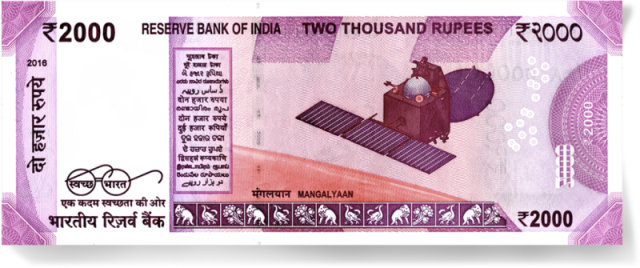

Demonetization has been one of the most tiring exercises that the Government put us through. The banks went helter skelter and so did we. There was not much clarity on the new rules or regulations; the only thing that was known was that the denominations of INR 500 and INR 1000 were no more useful and a new denomination of INR 2,000 was to be released in a couple of days with new 500s coming later on as well.

The consequences were chaotic! Long queues outside banks and ATMs, public refrained from basic necessities due to the ban on old notes. The sudden shocking move was justified as a trick to curb black money and money that is left floating around illegally. The move struck like lightening on the folks who were targeted but it also brought a host of restrictions on the general public.